A little tasteless, perhaps. But funny?

I thought so!

President Obama's Urinal Prompter

Make a Difference

A little tasteless, perhaps. But funny?

I thought so!

President Obama's Urinal Prompter

It really might be so – just not the way Al Gore thinks.

Measurements show that global atmospheric temperature has been static or cooling for the last ten years, despite increasing levels of CO2.

According to anthropogenic (human caused) warming theory, increasing CO2 and other greenhouse gases means increasing heat retention in the atmosphere. So how can the world be getting cooler when CO2 levels are increasing?

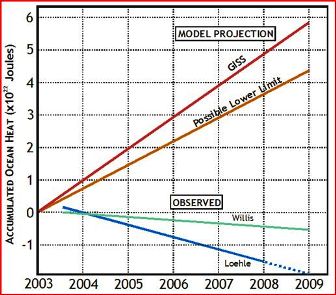

In 2005 James Hansen, global warming guru, along with a number of other NASA scientists, proposed that the oceans formed a reservoir for heat, and that ocean temperatures would continue to increase, even in the face of temporary (as they thought) blips in average global atmospheric temperature.

“Confirmation of the planetary energy imbalance,” they maintained, “can be obtained by measuring the heat content of the ocean, which must be the principal reservoir for excess energy”

Put simply, increasing CO2 and other greenhouse gases meant more heat was being retained. If that extra heat could not be found in the atmosphere, it must be being stored somewhere else. The only other place it could be stored was in the oceans.

So even when atmospheric temperature appeared to fluctuate in the short term (and they were confident any leveling or declines could only be short-term), ocean temperatures would continue to rise.

If this was not so, global warming theory was false.

The following graph shows predicted ocean temperatures if global warming theory is correct, compared with observed ocean temperatures.

Predicted vs Observed Changes in Ocean Temperature

If the oceans have not warmed despite increases in levels of atmospheric CO2, then additional CO2 is not causing any additional heat retention.

If additional CO2 is not causing additional heat retention, global warming theory is false.

The oceans are not warming. Global warming theory is false.

From the Beaufort Observer.

Is he for releasing Guantanamo prisoners, or not?

Is he for higher taxes, or not?

Is he for Israel, or not?

This excerpt is a good summary of why higher taxes and ‘stimulus’ spending just don’t work:

Also, he said that Obama has plans to raise taxes on US companies by $190 billion. And there’s when I quit, just gave up. If Obama raises corporate taxes, who does he think will pay them? Big companies don’t pay taxes. They just add them to the product they manufacture and pass it on down the line, When Wal-Mart receives that product, they add on a bit for profit and an extra bit to cover the higher cost and then stack it on the shelves. Then Susie Shopper comes along and buys it, paying the accumulated taxes along with the store’s profit. Or maybe Susie doesn’t buy it ’cause the extra few cents make it too expensive for her budget.

When gas was so high last year, the price of Georgia peaches went up. The price went up because the price for the gas to run the truck to bring the peaches to the grocery store went up. I knew the reason – all of us shoppers knew it. Raising prices at one end of the process simply raises the cost of the product when it gets to the consumer. It doesn’t take a math genius to realize that raising taxes on companies will raise the price of the end product and consumers will have to pay that price to get the product. Maybe the President just never shopped for groceries. Maybe the President just doesn’t understand how things work after all.

I would add that there are two other things companies can do in response to higher taxes (and therefore less cash available to run their business).

1. They can reduce the number of employess, which creates more unemployment. Which means a greater burden on the tax payer.

2. They can reduce profits, which means less income for superannuation funds, which means more need for government support for retired people. Which means a greater burden on the tax payer.

The same observations apply equally in Australia.

My advice to President Obama and Kevin Rudd, and Gordon Brown: If you don’t understand something, leave it alone.

Ill-planned tinkering in the financial system caused this crisis to start with. More ill-informed tinkering is not going to get us out of it.

Another boat load of illegal immigrants has been interecpted of the coast of Australia – the 12th boat this year.

According to Home Affairs Minister Bob Doofus, all the passengers are male, and all are from Afghanistan.

As usual, these are not the people most in need, the people a compassionate immigration and refugee policy would be focussing on. They are simply those with enough money or influence to push themselves ahead of anyone else, and pay to travel half way around the world.

Rudd’s new ‘softer’ approach is making things worse for the people who most need our help, and endangering the lives of those who don’t, but turn up anyway.

But of course.

Australian treasurer Wayne Swan says that tough measures to be introduced in tomorrow’s federal budget, are the fault of John Howard’s big spending policies.

When John Howard and Peter Costello’s government left office there was zero public debt, a substantial surplus (about $22 billion) lower taxes, record low unemployment, and higher real wages.

But it’s not our fault, say Rudd and Swan. It’s the wrong trousers. And they’ve gone wrong.

According to Swan ‘The opposition does not understand that the planned deficit is not a consequence of government spending.’ Ah. Right. OK then.

In February Peter Costello predicted the Labor government would never deliver a surplus budget. And of course was told he was a dinosaur, out of touch.

I agree with some of the measures to be introduced in tomorrow’s budget. The government shouldn’t be handing out money to people who don’t need it.

There is no reason why people on substantial incomes of $120,000 or more need me to subsidise their health care, or insurance, or home purchase, or baby clothes. Welfare and government support should be kept for those who really need it.

The Labor government is right to limit that kind of pointless spending – even though doing so is a breach of campaign promises.

But the savings will be minimal in terms of the overall budget. As will the increase in revenue from increasing the tax paid by the small percentage of successful people who already pay most, both in dollar terms and as a proportion of total taxes paid.

The real problem is massive and counter-productive ‘stimulus’ spending which will saddle ordinary Australian families with a debt amounting to between $10 and $15 thousand for every person living in this country.

If figures from the UK apply here, there will be another $10 to $15 thousand per person to meet Kyoto and ETS costs.

Rudd, Swan and their honchos are hopelessly divorced from reality.

One can only hope that some sort of cognitive dissonance will set in, and changes be made, before the Australian economy becomes a mess to rival the Augean Stables.

© 2024 Qohel