In 2007 Kathy and I needed to buy a new home. We had banked with the National Australia Bank for over fifteen years, so it never occurred to us to go anywhere else. This would be our fourth home loan with the NAB. All of our previous loans had been at the variable rate, or with very short fixed terms. This time we had no idea how long it would be before we needed to move again, so the flexibility of a variable rate loan was even more important.

We met with bank staff twice, and explained our needs. We were especially careful to make it clear that we did not know how long it would be before we needed to sell, and that we needed as much flexibility as possible. We finally agreed to a fixed term of one year, then moving to the standard variable rate.

Documents were given to us to sign with representations that they expressed the agreement we had made. Because we had banked with the NAB for so long we had no reason to doubt what we were told. But six weeks ago, we found that the documents we had been given did not express the agreement we had made. Instead of a loan with maximum flexibility, we had been signed up for the exact opposite; a loan with a higher interest rate, for a fixed term of ten years.

When we discovered this, we assumed it had been an honest mistake, and that the bank would be anxious to fix it. We could not have been more wrong. The reaction to our concerns was hostility, delays, and finally an outright refusal to consider anything we said. We even told them we did not want back the extra interest they had charged us, we just wanted the mistake, their mistake, to be fixed, now that it had been discovered.

We have been defrauded of between $3000 and $4000 over the last four years. The National Bank also tells us that instead of being able to pay out the loan or refinance with minimal costs, they will charge us nearly $8000 to make any changes, on a loan of just over $100,000.

We should have done more homework before going to the National Bank. In 2003 popular independent consumer website notgoodenough.org noted that the NAB was the most complained about of any Australian company. Not just the banks. The National Bank was the most complained about of any Australian company.

Ten years later, nothing much has changed. There have been media reports of NAB staff making statutory declarations they knew to be false, of falsifying loan documents, and of a pattern of complete disregard for the rights of their clients. See, for example, the website ihatethenab.com, or Bruce Ford’s bankdispute.com.au

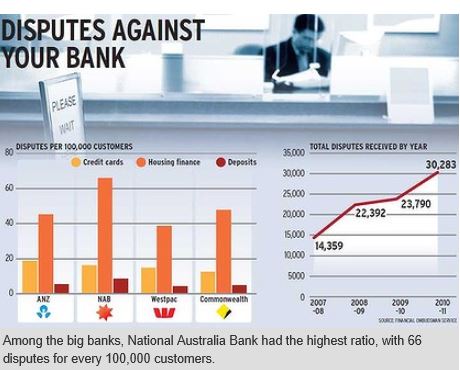

This is not just one or two disgruntled customers. As this graph from businessday.com.au shows, the National Bank continues to lead the industry in the number of complaints. The majority of those complaints relate to housing finance.

The National Bank can get away with treating its customers poorly, even dishonestly, because it knows that small customers like us do not have the funds to pursue justice through the courts.

What we can do, though, is to warn our family and friends. And that includes you.

If you bank with the NAB, for your own sake, change now.

Thanks for the warning.

Similar to my expeince with the NAB. Disappointing after years of banking with them. Could not belive the way my husband and I were treated when we asked for wrongly charged overdue fees to be reversed.

I have banked with all four of the major banks in different places. I don’t think the National Bank makes any more mistakes than the others, but there is definitely a diffrence in their attitude to their customers and their willingness to listen and try to resolve complaints. I will not go back to the NAB, even if they were the only bank in town.

I nearly paid attention to this until I saw just outdated the information is. Get it right. You’re worse than the bloody banks!!

Thank you Peter for presenting another forum for customers of NAB to have their say. NAB CEO Cameron Clyne has been laying it on pretty thick of late about his vision of turning NAB into the “people’s bank” and totally ignoring the fact that the true culture of NAB is a criminal organization that makes the Mafia look like choir practice.

If anyone has had a read of the investigative series currently running in The Australian newspaper it shows that all of our banks have indulged in predatory lending. Although the series is in relation to mortgage brokers; in our case we can prove that NAB knew that their employee had ‘fiddled the books’ and that we couldn’t’ afford the loan they approved.

People have a hard time believing that bit – they say but if you couldn’t afford the loan you shouldn’t have applied and accepted it. Thing is, NAB rejected our loan application, the acting bank manager did not tell us this, instead, she re-applied with dodgy figures which still showed we couldn’t afford the loan so she stated on the bank’s internal documents that we agreed that if we couldn’t meet repayments that we would sell everything. Well, we didn’t know this and would never have accepted the loan had we known the details.

NAB knew this – this was 2006 when they were throwing money around like drunken sailors; sure that property prices would keep going up and no-one would ever be the wiser to the scam. Conveniently NAB sacked the bank manager (or did they pay him out?)and began to systematically set us up so that we would be well and truly in the red when they pulled the plug. Then they relentlessly pursued us and refused to negotiate – still thinking we would never discover the fraud. And it almost worked … if not for some unusual events I would never have known the full extent of the corruption involved.

What hope does the average NAB customer have of discovering exactly how they were set up to fail – after all, don’t all banks sign the Banking Code of Practice which guarantees that banks will always look after the customer and they will not grant loans to people who can’t afford to pay them back? Don’t we have laws to protect us from financial scams designed for the sole purpose of relieving us of our property? Don’t they promise to fix any problems – especially the ones created by them?

Problem is NAB by name; nab by nature – they pretty much own everybody and have the deep pockets to engage in a full-scale cover up.

Do yourself a favour … don’t bank NAB 😉

@Barry, please do pay attention as this is still happening today. Right now there are families in court fighting to keep their homes when NAB knew that their lending practices were flawed. There are families who believed they were getting one kind of mortgage which would be covered under the hardship clause only to discover their bank manager had creatively given them a product that would ensure no hardship would qualify to allow them a couple of months saving grace. NAB does not negotiate with any customer they deem unable to fight back; it’s too easy to bully, intimidate and ensure the poor customer knows that even a basic legal dispute will cost close to $100,000. We are now suing NAB for damages – this fight will cost in the region of $300,000 – tell me, why if they broke the law and knew it, would they keep fighting in court, knowing that in a just and fair society the victim will win? The answer would be that they own the system and know the victim will run out of funds long before the matter is settled.

One case was thrown out of court not because the plaintiff didn’t have a case but because the judge said that they would run out of money before the evidence was heard – this after legal costs had run well over $54 million dollars (yes, you read that right, million).

NAB has been very busy settling a number of cases out of court of late – they haven’t offered enough money to the victims but they knew the victims were out of money and no longer had fight left in them (after 7 years fighting a case involving forged signatures and police not interested in investigating you tend to get a bit disheartened). Naturally all these settlements include the obligatory non-disclosure agreement which means NAB can carry on business as usual; nothing to see here.

When this all comes out it will make the current Murdoch scandal look pretty tame – NAB owns everybody it seems (look into who is on their board and the connections they have).

Pity no-one really sees the problem for what it is and blames the hapless customer who foolishly trusted a bank.

hmmm… Who are you Barry?

The only ‘out of date information’ is the page at notgoodenough.org which I specifically noted is ten years old.

The point of quoting that was to show that the current levels of dissatisfaction amongst NAB customers as evidenced in the businessday graph, is nothing new.

There is a long standing pattern of poor handling of customer complaints, and even outright dishonesty.

If you have current information showing that the NAB has mended its ways and is now a paragon of integrity and customer service, please post it.

Otherwise, who are you, really?

Thanks Barry. I think your post counts as an own goal for the NAB.

After my previous comment I checked the ip address of the computer from which Barry’s comment was sent.

This is some of the whois data for that address:

inetnum: 164.53.0.0 – 164.53.255.255

netname: NABAUS

descr: imported inetnum object for NAB

country: AU

admin-c: GW233-AP

tech-c: GW233-AP

status: ALLOCATED PORTABLE

remarks: ———-

remarks: imported from ARIN object:

remarks:

remarks: inetnum: 164.53.0.0 – 164.53.255.255

remarks: netname: NABAUS

remarks: org-id: NAB

remarks: status: assignment

remarks: rev-srv: DNSAU00.NATIONAL.COM.AU

DNSAU01.NATIONAL.COM.AU

remarks: tech-c: GW387-ARIN

remarks: reg-date: 1992-11-24

remarks: changed: hostmaster@arin.net 20010117

remarks: source: ARIN

remarks:

remarks: ———-

notify: greg_williamson@national.com.au

mnt-by: APNIC-HM

changed: hostmaster@arin.net 20010117

changed: hm-changed@apnic.net 20040926

changed: hm-changed@apnic.net 20030627

changed: hm-changed@apnic.net 20041214

source: APNIC

Guess what? “Barry” works for the NAB.

Fake names, fake email addresses, misleading comments. Obviously these are some of the strategies the National Bank considers OK in dealing with its customers.

Incidentally, “Barry’s” comment appeared shortly after I emailed these people:

Charles.X.Coy@nab.com.au

Jenny.M.Adams@nab.com.au

Leanne.K.Pearson@nab.com.au

Tim.X.Mead@nab.com.au

Martin.G.Pepperell@nab.com.au

to let them know about what I had written. These are all people who were part of “resolving” our complaint. If Barry is one of them, as I think he or she must be, this is an interesting comment on the integrity of the resolution process and the people involved in it.

Here a few more links for anyone researching the NAB’s banking standards.

NAB changes interest rates on a customer home loan in a deceptive way, and then send a duplicitous letter:

http://www.bransgroves.com.au/banking-and-finance/kay-v-national-australia-bank-ltd-2010-nswsc-1116.html

Choice says National Bank worst for complaints:

http://www.choice.com.au/media-and-news/media-releases/2011%20media%20releases/searching-for-the-worst-banks-just-got-better.aspx

Sydney Morning Herlad – Worst Customer Service Awards, inspired by an incident at the NAB:

http://blogs.smh.com.au/small-business/theventure/2009/11/30/the2009worst.html

By Professor Evan Jones NAB Spin Machine “The seed for later foul play is often sown right at the outset of the bank-customer relationship. Incorrectly documented loan applications or dysfunctional facilities – either incompetently or unconscionably conceived – facilitate the later dénouement of the customer.”

“The NAB never acknowledges a mistake — and is not happy to rectify one if called to account. The same incompetent and corrupt practices continue under Clyne’s watch (or negligence?). It will be business as usual.”

“Meanwhile NAB victims cry in the wilderness, hoping that somebody, somewhere, will take NAB spin at face value and respond sympathetically to their ill-treatment.”

http://www.independentaustralia.net/2012/business/finance-2/the-nab-spin-machine-in-overdrive/

Plus I have a personal issue with them over the way they treated me and my girlfriend over a couple of (slightly) late home loan repayments, and then claimed they could not get in touch with us. Never again.

Good article by Professor Jones. The National Bank has been the underbelly of Australian banking for years. I don’t understand how they have any customers left.

Thanks. Just crossed the NAB off our list of potential lenders.

Us too.

We have been talking to the local NAB manger about a laon to purchase an adjoining property. He’s a nice enough guy, but you can’t trust the organisation. Going after the Kays when the bank knew it was wrong is not just bad business practice, it is wrong, and from what we’ve read it happens all the time. It won’t change till the culture changes, and that not happening.

From Professor Jones

The Australian Prudential Regulatory Authority’s March 2004 Report into Irregular Currency Options Trading at the National Australia Bank provided a rare insight into the phenomenon of corporate culture and dysfunctional cultures in particular. (This report has been removed from the NAB website, and is not available on the APRA website.) Here are some snippets:

Lack of willingness by senior management to accept and acknowledge issues, resistance to escalation of issues and less-than-open responses to ‘external’ parties all are significant drivers of culture within an organisation, and so signals what is expected of staff within that environment. (p.75)

Sadly, the same for us. We moved to the National Bank becasue we were friends with our branch manager. When she left we might as well not have existed. There are some decent people working for the NAB, but there is something sick about a company that refuses to fix mistakes, and even takes people to court when it knows very well it is wrong. UNtil that sickness is healed, they cannot be trusted to look after your interests, only their own.

There are two banks near us, the NAB is one. We’ve been with them for a while now. Some of our friends have told us horror stories, even of staff telling them in your face lies. This is after complaints or disputes. Everything was fine till they had a problem. Then they were the enemy. THis was the attitude even from people they play netball or football with. There is somehting seriously wrong with any business that can make basically decent people act that way. We stayed with the NAB mainly out of inertia, just too hard to change. The Tess Lawrence video was the last straw for us. If the National Bank feels entitled to treat a customer that way, it is not the bank for us.

I love the NAB! I have never had an issue with them. They fixed a credit card problem for me quickly, got me a replacement card and refunded a bad transcation.

Andy, we felt the same and were happy with the NAB till something went wrong. As soon as a client has a complaint or dispute, everything changes. The client suddenly becomes a non person, and the bank seems to feel justified in doing anything to destroy them. Look at Peter’s story, or some of the stories on ihatethenab, or watch Tess’s video. It is horrifying what the National Bank will do instead of just admitting an error and trying to fix it. There is something badly wrong in the culture of the bank, so badly wrong that at times it is evil.

Quite frankly, if anyone in Australia is still a client of the National Bank they’ve got rocks in their head. The NAB doesn’t give a poop about its customers.

Re National Australia Bank Customer Complaints and Disputes

As someone who has worked in the banking industry I can tell you that the NAB resolve team has nothing to do with resolving customer complaints. Their entire purpose is to protect the bank’s interests no matter what. If anyone on staff actually said “Hey the customer is right, we should fix this and give them compensation for the losses and inconvenience we have caused them”, the rest of the staff would look at them like they were crazy and ship them off to marketing where it is perfectly OK to pretend the NAB cares about it customers.

You can have banked with the National Bank for years, but as soon as you have a complaint or dispute, all that history goes out the window.

Like others have said, there is a culture in the NAB that borders on evil in its disregard for truth and fairness.

Other banks get things wrong, but no other bank I know of has the same attitude to its clients.

Any other bank would be a better choice.

Another example of bad banking practice by the National Australia Bank, followed by vindictive legal action

http://sydney.edu.au/arts/political_economy/downloads/NABWalter507.pdf

Hi Peter

I have been a significant NAB customer for over 20 years , my recent experiences with the inadaquacies and unreliability of their Online banking service is leading me to question my faith in the NAB ,they are totally unresponsive to customer complaints for which I have submitted many, the only problem I have is not knowing if I am about to jump from the frying pan into the fire in moving my business to an alternative bank. Where can I find a comparisson between the 4 pillars

We made the mistake of telling NAB we were straggling with our loan, in one hand they said not to worry as they are not in the business of repossession,in the other hand they valued our property and asked us to bring it back to 80% LVR, knowing our house dropped in value, they advised us to refinance or sell.NEVER OFFERED HARDSHIP.

NAB advertising is really black and white in relation to what they are doing to a lot of mums and dads.[ where are our politicians,why have they not put into place policies to protect the public from pre-meditated bad, irresponsible loans]why are the banks not made to take responsibility and ware the losses after all they are investing in us, hopping we make money so they make money, why is it when banks straggle the government comes to the rescue with TAX payers money, the same people that are fighting to hold onto their nest egg.

Laws I believe should be implemented

1.Banks should be accountable 50/50 with the borrower specially if they are quick to lend,without doing there due-diligence,after all we trust the banks to tell us what we can afford 2.borrowers should not be black listed or declare bankrupt by banks, if it can be proved the the law and ethical conduct was broken.

3.banks cannot be intimidating,bulling,harassing,profiting by negotiating with the borrowers in there most vulnerable state, they must involve from day one a independent baking ombudsmen.

4.A must stop practise;you go to the bank to sign for the home loan, the manager takes out 500 pages that you have never seen until that day and say a one line sentence on each document fallowed by sign this.

After fighting for 3 years to hold onto my home, my health deteriorated I become a diabetic insolent dependent due to stress,this was a result from constant blocked number calls every day from NAB’S dept collectors,and letters of demand, the most i had in one day was 16 letters for the same loan.

But the worst thing NAB did was, when I went to the managers office to ask why are they doing this to me? his reply was “Terry don’t take it personally, it’s only business”.

we have an election coming up,we need to write a petition addressed to the politicians,this petition needs to be send to every one we know, they write their names and forward it to every one they know,the government will take note, not because they care but because they see votes.

My real name is not John , due to still being with the Nab I have to be careful.I have been a customer for years with the Nab,and have had millions borrowed and every loan payment paid on time. My business banker retired I believe due to the culture within the branch . They then gave me a banker who never answered his phone nor returned his calls, I complained about the service , who do think handles the complaint, the person about whom the complaint was made.I have correspondence stating that my facility does not expire until mid 2014 , but the conditions of the loan were changed to a variable rate and now my interest has gone up by 50% from 8% to over 12% , yet all my payments have been made on time . They say I do not have the capacity to make the repayments, how does making the repayments double what they would be any where else, help? Yet I still make the repayments on time.

They put you between a rock and a hard place , they make it as difficult as possible, every thing in their power to send you to the wall. In my case the assets they hold on a first mortgage are 4 times the loan amount ,they wanted valuations which would cost at least $7,000, which I did not have . One of the properties is to be leased to a multi national tenant, yet the new business banker (2nd one) said that value of property in that area had fallen. Well if they have fallen ,I did not cause it, I have maintained the building and found an excellent new tenant, commercial property values are to a very large degree based on the rent/ income generated by the property.

I have been employed in a business to business area where I have come across at least 10 people who have been sent to the wall or had it made very hard by the Nab and I believe there are hundreds out there in the small area that I am in that have been treated ambysmally. They give you an umbrella and when it commences to rain take it back.

I believe they are evil, greed is the purest form of evil.I believe business bankers are on a commission on extra income generated .They hate bad publicity and I for one would be prepared to protest out side their front door.I and many others have worked all their lives to get what little they have and they can take it away with the stroke of a pen,do they enjoy exercising power over customers , is it their 5 minutes of glory?

They work on the basis that you are only a small fry, there is strength in numbers, the time for talk has elapsed, action is required . They will continue to ruin people’s lives, they do not give a stuff, it is like water off a ducks back ,it just runs off.

I live for the day , when I move banks, they treat you like dirt.

Hi,my name is not Iann either. I am a business NAB customer going through a medical illness that has seen me off work much of this year. In the time I have been with NAB I have never once been close to late, nor have I ever failed a commitment, to them.

They have given me hell, it is the worst situation I have ever been in. Lies,deceit, the list goes on. I recently asked for minor assistance and it was refused. I am well under 80% LVR plus they hold an lien over my business. I have proof of some of their lies and poor service but am scared to make a proper complaint ,whilst I am still their forced client (fixed rate loans). My biggest mistake ever that instead of aiding my business has been negative and constricting.

So interesting to read previous comments. Dear fellow NAB victims. A week ago I checked my husband and my joint nab savings account to find our 600,000 had attracted $$$ interest, less $738 that automatically went to ATO. I phoned nab and questioned this deduction I from interest earned transactions. They reported that this money went to ATO since I failed to supplied my tax file number….not so as the NAB was supplied with my tax file number two years earlier and data relating to this initial account was used to open the recent joint account. Phone customer service informed me I could reclaim this on my tax. This bloody minded ness was reinforced by rude NAB branch staff responsible for the human error and the nab complaints team…..My husband and I argued we met our legal commitment by supplying the bank with tax file number, yet their stuff up resulted on severely impacting our quality of life as this interest is our only form of income since we are self funded retires. We requested they refund $738 but even though they admit fault take no responsibility in compensating us for this loss. I wonder what their process would be if we consciously misappropriated $738 of nab funds?

NAB BANK HAVE BEEN SO NASTY TO A DEAR FRIEND OF MINE WHOM FELLL ON HARD TIMES AS THEY WERE ASSAULTED AND SUSTAINED MANY INJURIES NAB WERE SO RUDE TO THEM AND THE LAST STRAW WAS WHEN A PERSON CALLED MELISSA GLASSSON AT RESOLVE MADE FUN OF MY FREINDS DISABILTY AND MENTAL CONDITION SHE REFUSED TO LISTEN TO THEM AND CONTINUED TO NOT HEAR ANYTHING SHE HAD TO SAY. SHE MADE FUN OF THEM WHEN THEY STUTTERED DESPITE BEING TOLD OF A DISABILTY AND MENTAL CONDITION.

WE ARE NOW IN THE PROCESS OF FILING A LAWSUIT OF THE NAB BANK. FIRE THAT DISGRACEFUL EMPLOYEE.

Nothing on some of the others, but I have just spent the weekend and Monday stuck at home with an unregistered car and a nasty flu. Despite trying to inform the bankers about this situation, and they promised to give me an answer by the end of today about a credit increase, I am still stuck at home without an answer or painkillers. I can’t get to a doctor or a chemist without a punishing walk. The risk of incurring a fine keeps m car in the garage.

The NAB is a heartless mob of money grabbers, and I am now very much looking forward to changing banks at the earliest possible convenience. Sure, I might not get any better elsewhere, but I know for CERTAIN that the NAB don’t value me as either a customer or a human being.